- CCI - Elite Cryptocurrency Investment Strategy Newsletter

- Posts

- Bitcoin Enters Bear Market - These 3 Top-10 Alts Could Fall 50% (Premium)

Bitcoin Enters Bear Market - These 3 Top-10 Alts Could Fall 50% (Premium)

Edition 175 - The Elite Cryptocurrency Investment Strategy Newsletter

Today’s Core Points:

Bitcoin crashes into Bear Market

Doom Gloom and a Ray of Sunshine

3 Top-10 ALTS staring down a 50% decline, and what they must do to avoid it

PREMIUM NEWSLETTER FOR PAYING SUBSCRIBERS (Released every Thursday)

Hey all,

Bitcoin just confirmed a bear market. Not "maybe." Not "we'll see." Confirmed.

And if you think that's bad news for BTC, wait until you see what it means for altcoins.

Today I'm walking you through three TOP-10 charts that should have your full attention. Each one is breaking down from its weekly structure, and the next few weeks will determine whether we see a recovery rally or a gut-wrenching 50% decline.

This isn't doom and gloom. This is reality. And if you're positioned correctly, you'll either protect yourself from disaster or set up for opportunity when others are panicking.

Let's get into it.

Bitcoin: The Bear Market Is Here

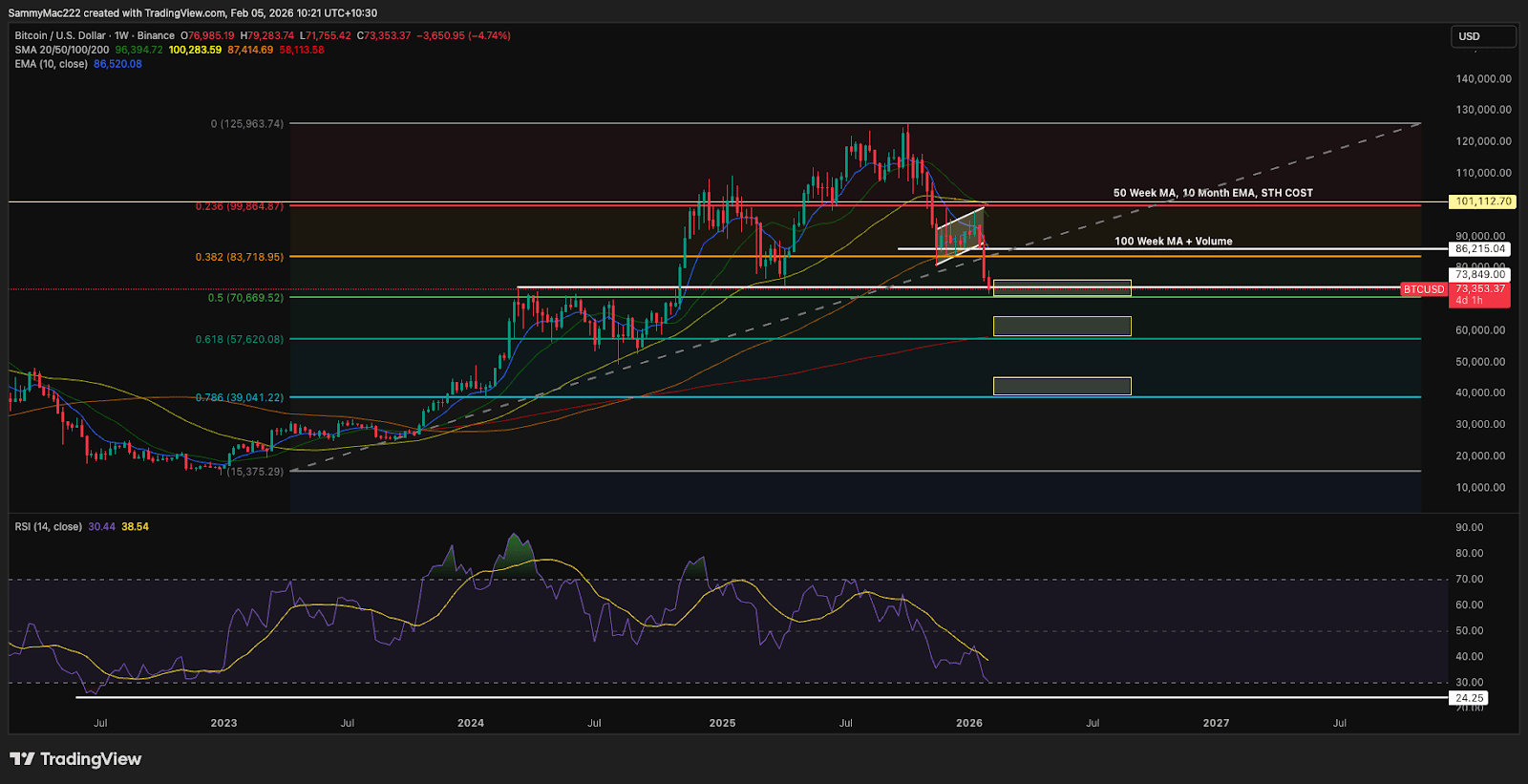

BTC has now fallen 40% from highs and failed a re-test of 100k.

The violent crash through the 100 Week MA and True Mean (average price of investors) has forced a re-think of the immediate term. If you've been readers and clients of ours you’ll know this is where the “if this, then that” strategy protects you from being hooked into a bias and preserving capital.

My macro thesis for 2026 has not changed but it's clear Bitcoin wants lower before higher. Long term investors will be licking their lips for patient entries.

Here's what matters now:

Key Support Level: [$74,000- 68,000] - This is now the line in the sand. BTC now erased the entire Trump election Pump and this area is being used as a pincushion and should provide the strongest we’ve seen so far on the way down.

Keep in mind that every time Bitcoin has lost its 50 (yellow line) and 100 Week Moving Average (orange line) it has gone to test its 200 Week MA (red line). Therefore $[62,000- 58,000] remains an enticing prospect. We also normally see a weekly reset on the RSIwhich Bitcoin has not yet reached.

On my chart you can see I have placed a 3rd box at the 78% retrenchment level (blue line) this is an outlandish area for price to land but it managed to get there in the FTX collapse.

What to Watch:

ETF flows (still the most reliable leading indicator we have for demand). Outflows continue as new holders panic - we must see consistent inflows. Can monitor here. https://farside.co.uk/btc/

Weekly close behavior - a close below $[74,000] confirms continuation (April 2025 lows)

Volume on the breakdown - low volume = fake out potential; high volume = real move

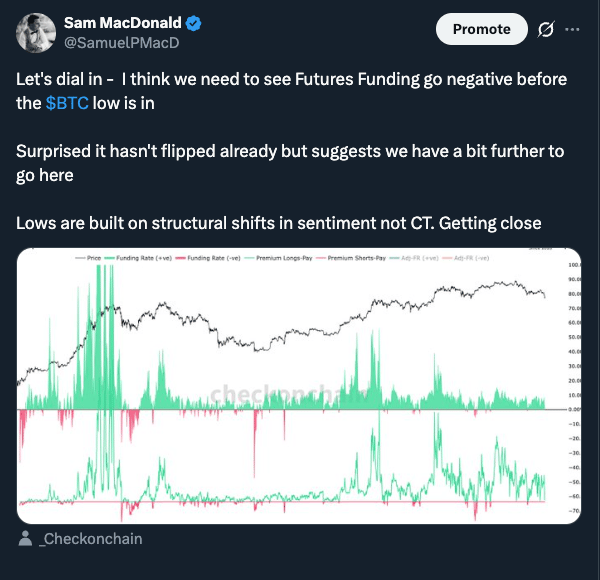

An early end to the bear based on violence of sell-off and positive Macro. Watch for Funding rates to move negative, strong volume, ETF inflows, a sell pressure catalyst reveal (FTX for example)

Bottom line: Until it proves otherwise, expect continued pressure across the board and for this violence to culminate in a strong capitulation move into lower areas. You will have plenty of time to buy the lows - bottoms do not happen overnight, so be patient.

Ok, this brings us to the real danger zone: altcoins.

The 3 Charts That Could Drop 50% (And What Must Happen to Stop It)

[PREMIUM SUBSCRIBERS ONLY - Upgrade to continue reading]

This is what you get as a Premium Member every week—charts, levels, and action plans for the top movers. No fluff. No hopium. Just what works.

Get your 30days FREE Trial and read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Proven Multi-Million Dollar Weekly Insights To Accelerate Your Results

- • Monthly asset selection and strategy analysis

- • High, Medium & Low Risk Profile Breakdowns

- • Knowledge From An Elite Team With Over 71 Years Combined Crypto Experience

Reply