- CCI - Elite Cryptocurrency Investment Strategy Newsletter

- Posts

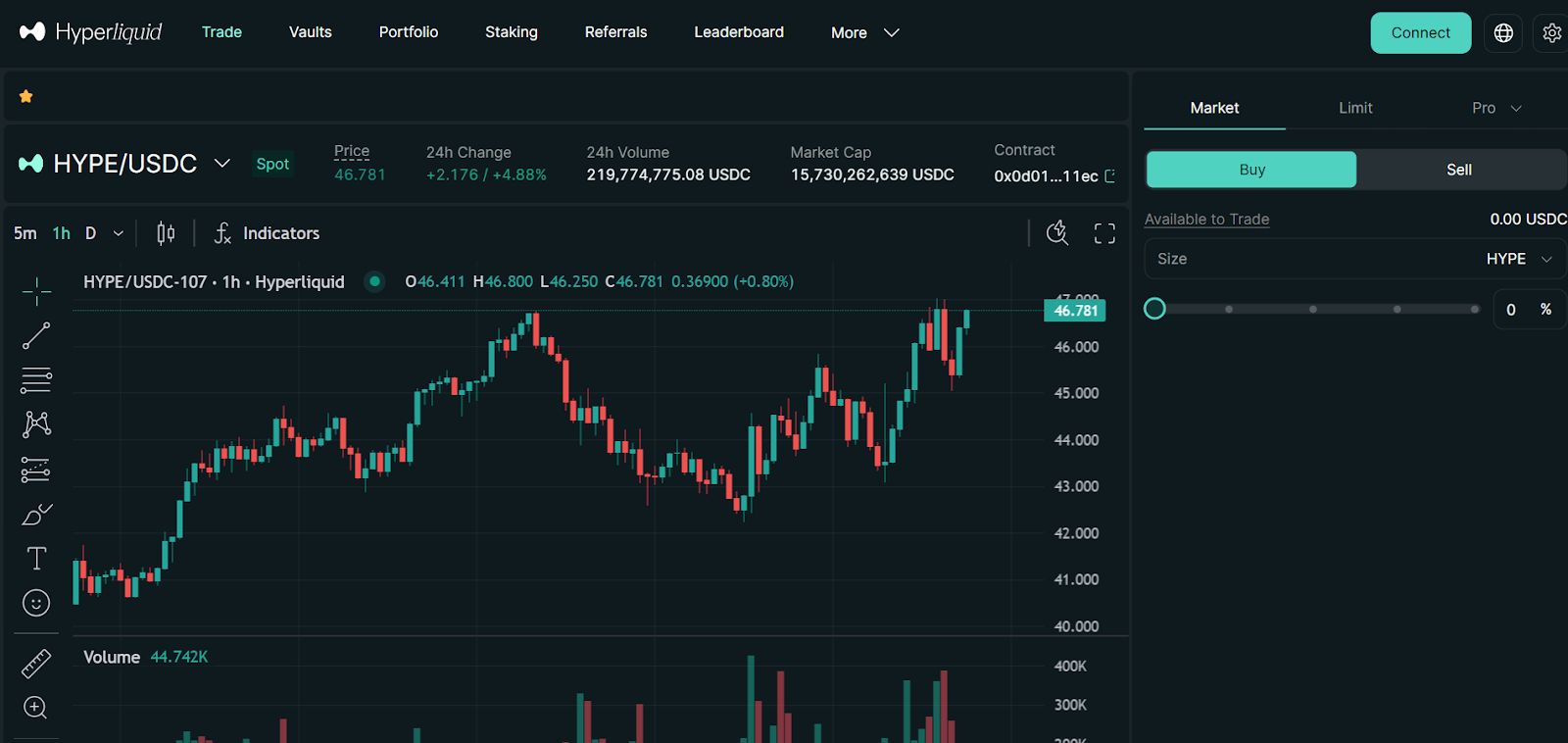

- Catch the $HYPE Before It Goes Parabolic

Catch the $HYPE Before It Goes Parabolic

Edition 150 - The Elite Cryptocurrency Investment Strategy Newsletter

A New Era for Derivatives

Imagine trading with the speed and features of Wall Street’s best exchange, but on a public blockchain. That’s the vision driving Hyperliquid: a high-performance Layer‑1 built for derivatives. In contrast to traditional markets (closed, permissioned, and often offline on weekends), Hyperliquid offers permissionless, 24/7 trading of perpetual futures entirely on‑chain. It exemplifies the new wave of “hyper‑efficient” DeFi layers – combining ultra‑low latency infrastructure with fully transparent smart‑contract rails.

Hyperliquid aspires to turn all financial markets (from crypto to stocks and commodities) into user‑programmed blockchain apps. By natively implementing order books and perpetual contracts on its own blockchain.

This shift is part of a broader trend: on-chain derivatives protocols are proving they can match or even exceed centralised venues in performance while remaining fully open and trustless. In fact, as of mid‑2025, Hyperliquid’s native token HYPE has been one of crypto’s best performers (up ~+64% year‑to‑date, compared with Bitcoin at +11% and other tokens down). This market success reflects not hype alone but the underlying technology: Hyperliquid delivers CEX‑grade speed with on‑chain transparency, a combination that is resonating strongly with traders and builders.

What is Hyperliquid, in Plain English?

Hyperliquid (token HYPE) is a decentralised crypto exchange built for perpetual futures, but on a blockchain architected from the ground up for speed. In plain terms, it works like a crypto trading platform where all orders and trades are recorded on-chain, yet it feels as fast and intuitive as a centralised exchange. Hyperliquid provides the ease of use of a CEX – one‑click trades, market and limit orders, take‑profit/stop‑loss, even partial fill (TWAP) orders – but without any middleman or custodian. Every trade runs through audited smart contracts, so users keep custody of funds at all times, and every ledger change is public and verifiable.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Proven Multi-Million Dollar Weekly Insights To Accelerate Your Results

- • Top 10 Crypto Portfolio With Multiple Buy & Sell Levels

- • High, Medium & Low Risk Profile Breakdowns

- • Knowledge From An Elite Team With Over 64 Years Combined Crypto Experience

Reply