- CCI - Elite Cryptocurrency Investment Strategy Newsletter

- Posts

- HOLD TIGHT: Fall Before the Sept Rally (Paid Edition)

HOLD TIGHT: Fall Before the Sept Rally (Paid Edition)

Edition 149 - The Elite Cryptocurrency Investment Strategy Newsletter

Today’s Core Points:

- Why August is moving RED

- The Simple Strategy To Limit Stress & Maximize results

Let’s dive in!

PREMIUM NEWSLETTER FOR PAYING SUBSCRIBERS (Released every Thursday).

Hi everyone,

August is flashing red, and your portfolio might feel the heat.

I know, I know, it’s not what you wanted to hear. Short term shifts can be hard to identify and pre-empt, especially when people are shouting “up-only” and green candles mess with sober decision making.

We are speculating on what is likely - reading the tealeaves.

It’s not forever, or a top, far from it - we are macro bulls. But opportunity has come knocking and we think there is solid ground for an August contraction heading into one of the most anticipated macro events of the year.

The first Rate Cut of 2025.

Remember it’s just noise. I’ll share with you below a simple stress-free strategy to find your Zen in the motion of the market.

Let’s dive in.

Why August is Moving RED

Seasonality still matters. Bitcoin has been unusually strong through American Summer but this where speculative capital tends to go to sleep until September. Bitcoin returns have been mixed, with an average return of 1.75% it’s often seen double-digits in the negative. It’s logical to assume that August will finish flat or corrective.

We believe the primary reason for a contraction into September is a sudden shift in the US economic outlook…

A softening of the US labour market.

Jobs…really?

Yes. Up until this week the US FED had no plans to cut interest rates and had miraculously avoided a recession backed by strong economic figures and falling inflation (golilocks zone).

That all came crashing down this week when jobs growth for June/July was revised down by 258k jobs. This equates to one third of jobs growth for the entirety of 2025!

This paints an entirely different picture of the health for the US economy and also points to the FED’s decision making, which is based on these numbers.

This was a shock.

With the FED’s core mandate centered around employment stability and a “not as good as they thought” jobs market, this all but ensures we see a rate cut in Sept.

CME futures is pricing a 90%+ probability on a cut.

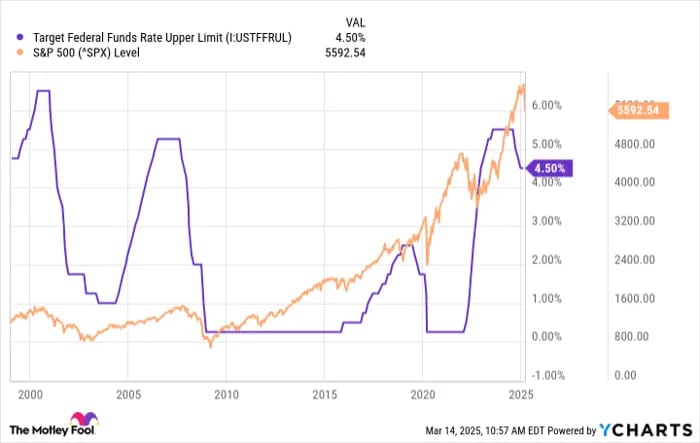

What might a rate cut do?

In short: it reduces the cost of capital and increases liquidity flows via lending = higher asset prices.

The optics that we are entering a period of looser monetary policy means speculation will increase as the consensus is that lower rates drive new liquidity.

In the economy it will ease credit repayment stress, increase borrowing power, juice speculation & reduce the national interest burden. It will also allow other major Central Banks to increase stimulus as cuts reduce the strength of the US Dollar.

That’s Bullish Right?

Overwhelmingly yes…but maybe not right away.

What's the old saying: if everyone thinks something is immediately bullish then...

The contraction we are seeing could be caused by uncertainty.

Markets have been blindsided by data that says the economy is a lot less rosy than projected and instead of strength, we now need to price in a potential drift toward recession!

Ok…

Cuts are positive in the medium term for risk markets but we must remember that rate cuts almost always see negative SHORT TERM downside moves in stocks due to their implication that the economy is slowing. It implies lower revenues, less spending and more job losses.

The core difference here is that cuts aren’t really being forced on us via a major crash - so if cuts begin without one, then chop is all we may get before Crypto takes off again. Food for thought.

Right now being cautious in August seems prudent in-case we follow the traditional path where an unwinding needs to occur.

We could of course front-run the entire circus and power through, however I think this event will be a consequential moment no matter the price action. My most probable scenario has us chopping into Sept before we move higher giving us one last buying opportunity before Bitcoin takes out $120,000.

Watch my Exclusive Mastermind Strategy Session on this here:

No-one knows the future so don’t stress on each green and red candle - make a simple plan that allows you to close the laptop and walk away. Here’s ours…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Proven Multi-Million Dollar Weekly Insights To Accelerate Your Results

- • Top 10 Crypto Portfolio With Multiple Buy & Sell Levels

- • High, Medium & Low Risk Profile Breakdowns

- • Knowledge From An Elite Team With Over 64 Years Combined Crypto Experience

Reply