- CCI - Elite Cryptocurrency Investment Strategy Newsletter

- Posts

- Shedding the 4-Year Cycle - 2026 belongs to BULLS (Paid Edition)

Shedding the 4-Year Cycle - 2026 belongs to BULLS (Paid Edition)

Edition 167 - The Elite Cryptocurrency Investment Strategy Newsletter

Today’s Core Points:

- Fundamentals are divergent from price and the Board has been reset.

- What needs to happen for a new Bull Market

- Strategy bottomed this week, so did Bitcoin?

- 2 mega 2026 catalysts not being discussed

- My Honest thoughts in Closing

PREMIUM NEWSLETTER FOR PAYING SUBSCRIBERS (Released every Thursday).

Hey all,

I want to lift you up from the canvas.

Last month we wrote why a multi-year Bear Market is unlikely, and that hasn’t changed. In fact, our conviction on 2026 is rock solid.

November’s aggressive price drop has only reset the board faster.

It’s odd timing that Bank of America, ETF giant Vanguard, and now Charles Schwab, are all announcing their entrance into Crypto after a major capitulation…

It’s the playbook of Wall Street - they want what you have at lower prices.

Panic, fear, and a collapse in entrenched narratives causes maximum destruction like a forest fire. It seeks out the inefficiencies in the market and sets the stage for our next move in 2026.

Simply: Bitcoin is more attractive at $80,000 than it was at $126,000 to institutional buyers.

It’s OVER!

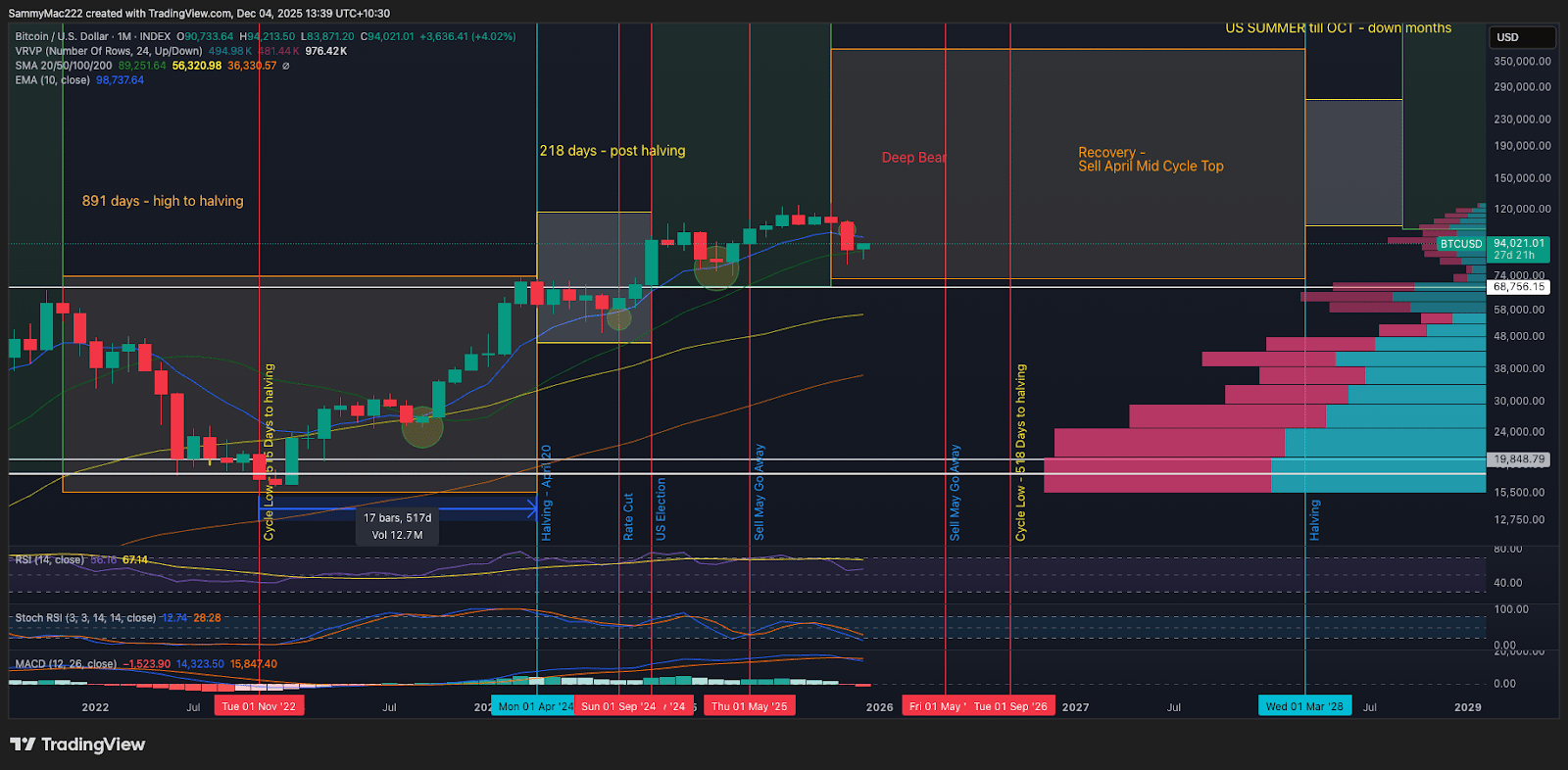

The 4-year cycle is done - a self fulfilling prophecy or has it morphing into something new in the ETF era?

I argue strongly that it is the latter.

According to our cycle map, the cycle ended in October (time-wise) so, now we wait…

Our thesis could be wrong, but if BTC were to reclaim its Monthly 10 EMA above 103k, then a new bull cycle is likely to begin, and this will be seen as another forgettable correction in Bitcoin’s macro uptrend.

What if Bitcoin is faking everyone out, except only the most patient of investors?

We sit in the post-correction sweet spot. A correction that has bear market low characteristics (according to the data), and I don’t think we've seen a more favourable macro environment for Bitcoin than we have before us now.

We could be in a bear, sure…anything is possible.

However, a rally now or in 2026 will lift the weight of the 4-year cycle narrative from the market’s shoulders and end the debate.

🎄✨ 3 Days to Go! 🚤

We’re almost ready to set sail for the CCI Yacht Christmas Party — just 3 days left until the most exclusive crypto celebration of the year!

🎟️ Everyone’s invited — book your ticket now:

https://cryptoconsultinginstitute.com/cci-christmas-party-2025/

See you on board! ✨🎁

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Proven Multi-Million Dollar Weekly Insights To Accelerate Your Results

- • Monthly asset selection and strategy analysis

- • High, Medium & Low Risk Profile Breakdowns

- • Knowledge From An Elite Team With Over 71 Years Combined Crypto Experience

Reply