- CCI - Elite Cryptocurrency Investment Strategy Newsletter

- Posts

- The Digital Gold Rush: Why Smart Money Is Moving Into PAXG

The Digital Gold Rush: Why Smart Money Is Moving Into PAXG

Edition 168 - The Elite Cryptocurrency Investment Strategy Newsletter

How Tokenised Gold Became One of the Smartest Defensive Investments for Everyday Investors

Understanding $PAXG

For most everyday investors, owning gold seems straightforward… until you actually try to do it.

Buy physical gold?

Suddenly, you’re dealing with storage, insurance, transport, authentication, and the hassle of selling it later.

Buy gold through an ETF or a bank?

That’s simpler — but you don’t actually own physical gold. You own a paper claim. You get exposure to gold’s price, not gold itself. If you ever wanted to withdraw the metal? Not possible.

This gap in the market is exactly why PAX Gold (PAXG) was created.

PAXG is a digital token that represents real, physical gold stored in a secure vault.

One PAXG = one ounce of gold - Simple

It is the blockchain version of holding a gold bar, without the friction, cost, or inconvenience.

It combines the safety and trust of gold with the speed and flexibility of crypto.

What PAXG Actually Is

PAXG is a tokenised commodity, meaning it's a digital representation of a real-world asset.

Each PAXG token corresponds to:

1 Troy ounce of investment-grade London Good Delivery gold

Stored and insured in Brink’s vaults in London

Fully custodied and audited

Owned by you, not a bank or fund

PAXG is essentially a digital receipt for a specific bar of gold.

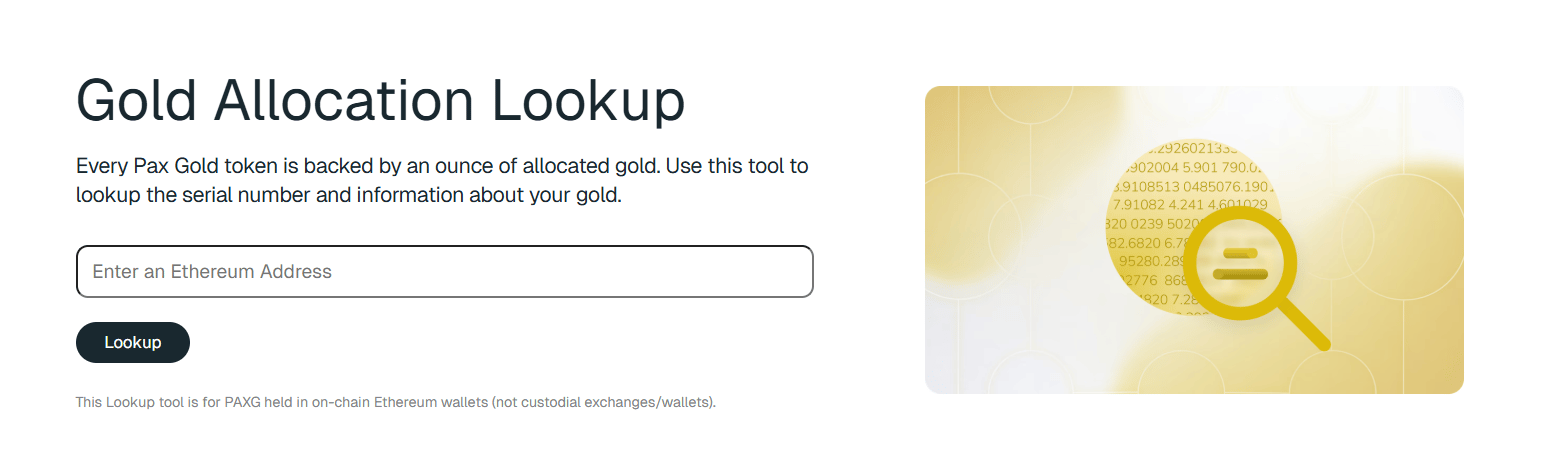

You can even look up the unique serial number of the gold bar allocated to you.

This matters because, unlike ETFs, there is no “pooled ownership.”

You own actual gold, not a claim on a custodian’s balance sheet.

Why PAXG Exists

Gold is one of the world’s oldest safe-haven assets.

But its traditional form has significant limitations:

Slow to buy or sell

Difficult to store securely

Expensive to transport

Hard to divide

Not easily transferable

Typically available only during business hours

Requires trust in intermediaries

PAXG solves all of these problems.

With PAXG, gold becomes:

Instantly transferable worldwide

Tradable 24/7 on crypto exchanges

Fractional (you can own any amount, even $10 worth)

Easily converted into Bitcoin, Ethereum, or stablecoins.

Secure, audited, and regulated

A perfect hedge within a crypto portfolio

It takes a very traditional asset and upgrades it for the digital age.

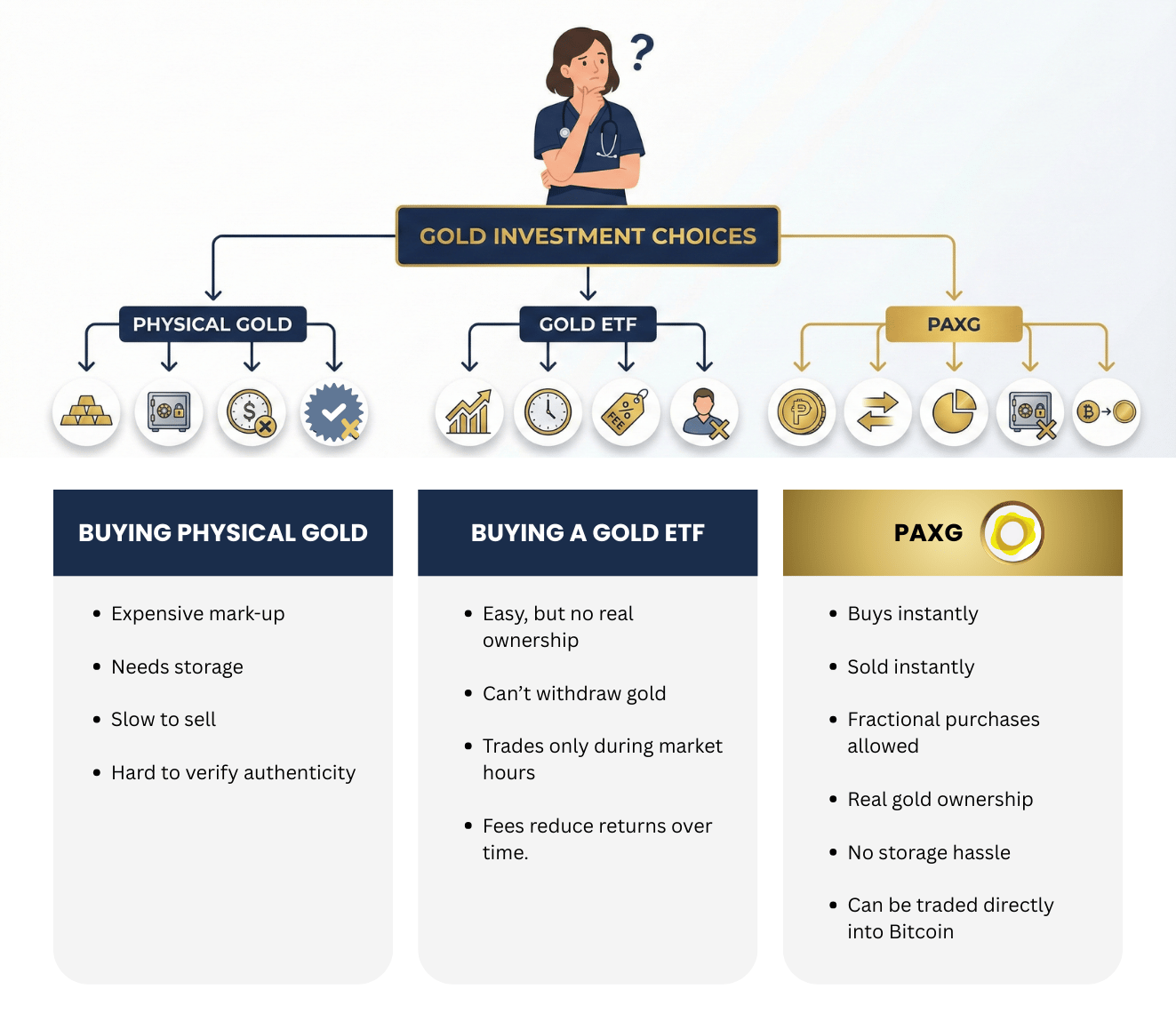

Sarah the Nurse

Sarah is 37, a nurse in Sydney, and wants to protect part of her savings from inflation and global uncertainty.

She compares her options:

For Sarah, the choice becomes obvious:

PAXG gives her safety and convenience at the same time.

Daniel the Crypto Trader

Daniel is already in crypto and understands market cycles.

During crypto volatility, he typically rotates into a stablecoin like USDT — but stablecoins don’t protect against inflation, and they don’t appreciate.

Gold does.

With PAXG, he can rotate into a defensive asset without leaving the crypto ecosystem.

He gains:

A hedge against global uncertainty

Protection during Bitcoin corrections

A way to stay on-chain

Direct trading pairs (PAXG/BTC)

A safer long-term asset than holding stablecoin cash

For crypto-native investors, PAXG acts like an on-chain version of a gold ETF — but with real ownership.

How PAXG Works

Get your 30days FREE Trial and read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Proven Multi-Million Dollar Weekly Insights To Accelerate Your Results

- • Monthly asset selection and strategy analysis

- • High, Medium & Low Risk Profile Breakdowns

- • Knowledge From An Elite Team With Over 71 Years Combined Crypto Experience

Reply